Is your QuickBooks going to blow up?

“It’s a ticking time bomb.”

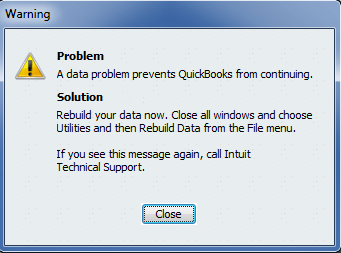

That’s how one of my colleagues recently described her client’s QuickBooks Enterprise file. Nobody in the meeting disagreed with her blunt assessment. She continued: “The file has been used for years and keeps getting slow, unstable, and corrupted. Repeated rebuilds and visits from QuickBooks recovery experts have kept it functioning, barely. Nobody knows when will be the last time it works.”

Not a day later, another longtime friend from my old firm told nearly the same story about his company’s QuickBooks Enterprise file. As they’ve grown, sales and inventory transactions have piled up in the system, and it has nearly ground to a halt. “Because we have 10 years of inventory and because of how we numbered our inventory, our QuickBooks file had gotten huge,” my friend said. “Our balance sheets wouldn’t balance, and historical amounts were changing. Of course, QuickBooks has options to verify, rebuild, and condense. None of those would work. We can’t even do a backup using the QuickBooks backup.”

I’d be lying if I said I was surprised at hearing these tales back-to-back. Over years of working with midsize and growing businesses, I’ve seen my share of unstable QuickBooks files. Googling the term "corrupted QuickBooks file" yields page after page of advice for rebuilding files and even more of consultants who specialize in recovering data from crashed QuickBooks systems.

That corruption in aging and over-tasked QuickBooks files is only one of the loss risks Revolution Accounting has seen. One client had their only good copy of QuickBooks on a laptop that took an unplanned cup of tea to the keyboard and lost all their data. Another entrusted their file to a less than stellar bookkeeper who refused to give it back after a legal dispute erupted.

While QuickBooks is fine for a company just getting going, its functionality and transaction capacity are limited and its reporting is often lacking in the flexibility and dimensional views an organization needs to manage growth.

The problem stems from a growing business or nonprofit holding on too long to a system that is built for small organizations with relatively simple needs. In contrast with QuickBooks, multi-tenant cloud applications like Sage Intacct are designed from the outset to be scalable. A company could start out with just one or two accounting users – or even outsource their accounting to a Sage Intacct Accounting Partner – and then add users, functionality, and transaction volume as needed without ever running out of headroom or risking loss of their priceless data.

How big could you go? Top Sage Intacct customers include those that are

Supporting over 3,500 users

Running over 1.5 million transactions per month through Intacct

Managing over 12 million revenue recognition schedules

Managing over 650 entities

Global companies running Sage Intacct have entities using more than 150 different currencies.

Dozens of companies, including Guidewire, GrubHub, and Tiger Logic, have ridden Sage Intacct right through their SEC filings and IPOs and continue to rely on its powerful financial capabilities as public companies.

The multi-tenant infrastructure built to support these kinds of organizations is the same as what every other Sage Intacct customer is running on, including redundant failover server locations, minute-by-minute rollback capability, and robust security features. Needless to say, none of them is about to be taken down by a cup of tea.

To find out more about how to defuse an imminent catastrophe in your accounting system, check out our software page, visit Sage Intacct’s Outgrowing QuickBooks guide, or just ask us! (Hint: clip the blue wire last. I saw that in a movie, so it’s probably accurate.)